In Malaysia, the concept of group economics runs deep, rooted in the spirit of community and collaboration.

By pooling resources and leveraging collective efforts, Malaysians have long embraced the power of unity to achieve shared financial goals.

In this guide, we’ll explore how group economics manifests in Malaysian society and how individuals can harness its strength to enhance their financial well-being.

- Community-Based Savings Clubs: The Traditional Way

- At the heart of Malaysian group economics are community-based savings clubs, known locally as “Arisan” or “Kootu.” Members contribute a fixed amount regularly, rotating the collected funds among participants. This collective saving and borrowing system fosters solidarity and provides financial support when needed.

- Investment Clubs: Uniting for Financial Growth

- Malaysian investment clubs bring together like-minded individuals with a shared interest in investing. By pooling funds and expertise, members collectively analyze investment opportunities, diversify risks, and pursue financial growth. These clubs democratize investing, making it accessible to a broader segment of society.

- Cooperative Societies: Strength in Numbers

- Cooperative societies, or “Koperasi,” play a vital role in Malaysian group economics. These member-owned organizations operate on principles of mutual aid and collective ownership. Malaysians join cooperatives to access financial services, purchase goods at discounted rates, and participate in profit-sharing schemes.

- Community-Based Crowdfunding: Empowering Entrepreneurs

- With the rise of technology, community-based crowdfunding platforms have emerged in Malaysia. These platforms allow individuals to raise funds for entrepreneurial ventures, community projects, or personal causes. By tapping into the collective support of their networks, Malaysians bring their ideas to life.

- Group Purchasing: Bulk Buying Benefits

- Malaysians often engage in group purchasing to leverage economies of scale and negotiate better deals. Whether it’s buying groceries, household goods, or organizing group travel, pooling resources reduces individual costs and maximizes savings.

- Joint Ventures and Partnerships: Collaboration for Business Success

- Malaysian entrepreneurs frequently form joint ventures and partnerships to combine resources and expertise. By sharing risks and rewards, businesses can access new markets, innovate, and grow faster than they would independently.

- Rotating Credit Associations: Access to Capital

- Rotating credit associations, known as “Tandas” or “Chit Funds,” provide access to capital for Malaysians who may not qualify for traditional bank loans. Members contribute to a common fund, taking turns to receive a lump sum that can be used for various purposes, from business ventures to personal expenses.

- Social Lending Platforms: Peer-to-Peer Finance

- Social lending platforms connect borrowers with individual lenders, bypassing traditional financial institutions. Malaysians use these platforms to access credit at competitive rates while providing investors with opportunities to earn returns on their investments.

- Resource Sharing and Bartering: Trading Skills and Services

- Malaysians engage in resource sharing and bartering to exchange skills, services, or goods without the need for cash transactions. This informal economy fosters community bonds and allows individuals to access resources they may not otherwise afford.

- Education and Knowledge Sharing: Empowering Through Information

- Malaysians participate in education and knowledge-sharing initiatives to empower themselves and their communities. Workshops, seminars, and mentorship programs provide valuable insights into financial literacy, entrepreneurship, and investment opportunities.

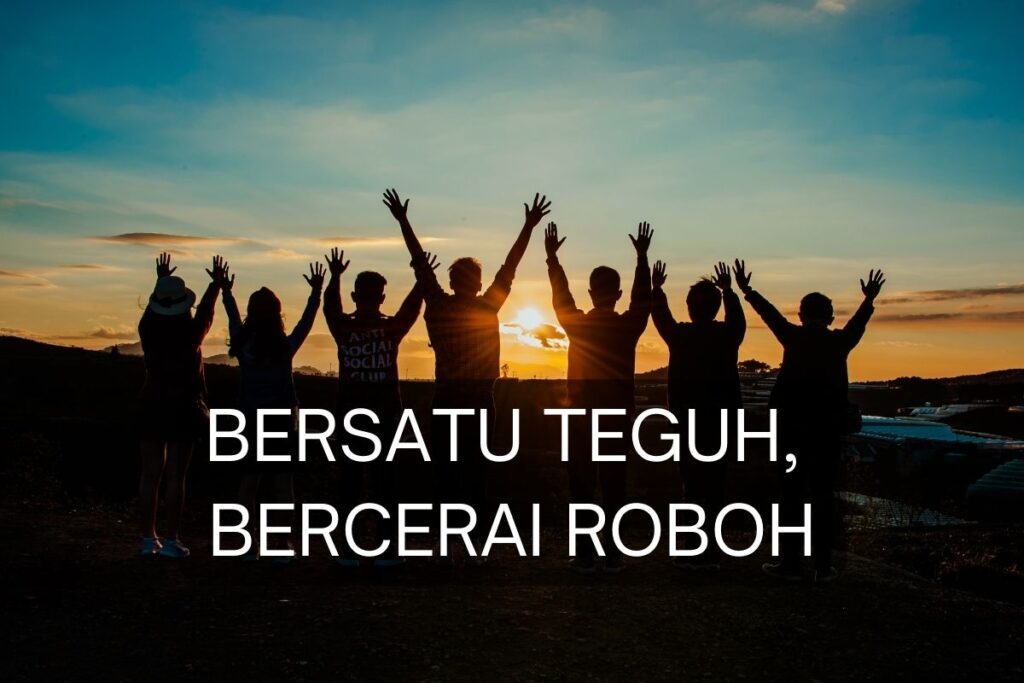

The power of group economics in Malaysia lies in its ability to foster solidarity, empower individuals, and drive collective prosperity.

By embracing collaboration, Malaysians leverage their collective strength to achieve shared financial goals, support one another, and build resilient communities.

As the saying goes, “Bersatu Teguh, Bercerai Roboh” – united we stand, divided we fall.